Overview of Income & Expenses

Managing income and expenses is the backbone of any financial system.

In our Systemized Hybrid approach, this module provides a structured way to record,

monitor, and analyze all financial transactions within an organization.

By systemizing these records, institutions can not only maintain transparency

but also generate accurate reports for decision-making and auditing purposes.

Key Sub-Modules Included

Bank Database – Manage all bank accounts and transactions.Heads of Credit – Classify and track all incoming funds.Heads of Debit – Organize and monitor expenses.Receipt Vouchers – Record collections and payments received.Payment Vouchers – Document all types of disbursements.Ledger Prints – Maintain a detailed record of accounts.Cash Books – Summarize daily inflows and outflows of cash.Trial Balance – Generate a quick snapshot of financial accuracy.

Note: Each of these sub-modules will be explained in detail in upcoming sections

with real examples, screenshots, and code integrations for practical understanding.

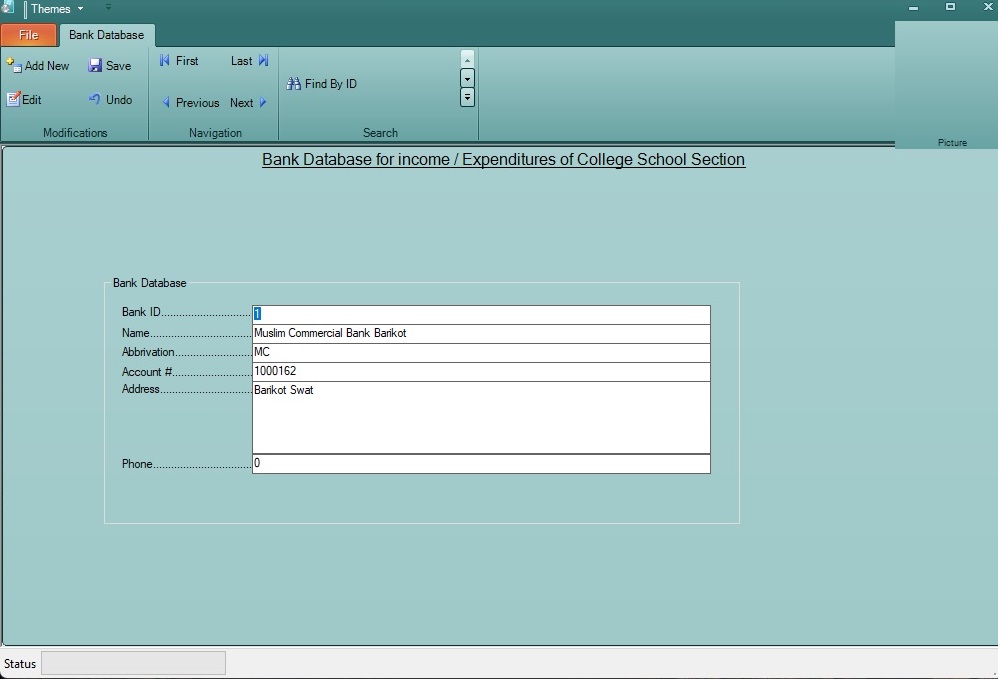

Bank Database

The Bank Database sub-module is designed to record and manage all

the banks (or equivalent financial entities) where funds are deposited.

However, in our Systemized Hybrid approach, we also allow flexibility

for users who may not wish to register with an official bank.

In such cases, the system enables recording the user’s name instead

of the bank’s name. This ensures smooth account management even when the

transactions are handled internally by an authorized individual rather than a bank.

Key Features

- Record the

Bank Name where deposits are held.

- Option to record a

User Name instead of bank name,

for users who do not deal directly with banks.

- Store essential details such as branch, account number, and authorized handler.

- Enable seamless linkage of this database with

Receipts,

Payments, and Ledgers.

Note: This flexibility ensures that whether you operate through

a formal bank or an internal user-managed account, the system maintains

consistent records. This is especially useful for small organizations or

educational institutions that prefer handling transactions independently.

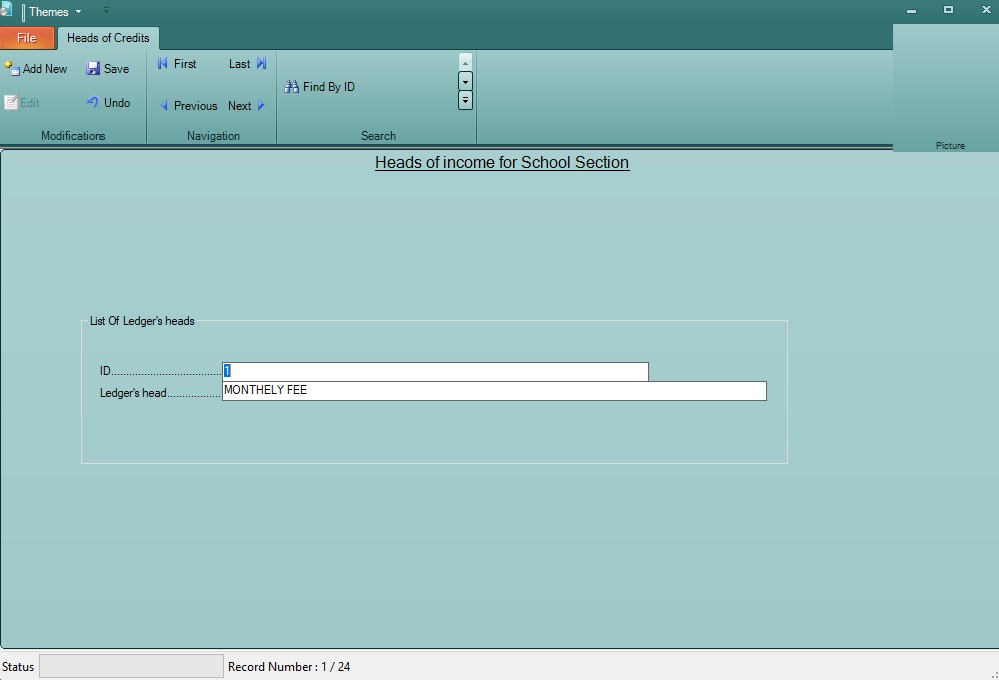

Heads of Credit / Income

The Heads of Credit / Income sub-module is used to categorize

all the incoming funds within the Systemized Hybrid system.

To ensure stability and accuracy of financial reporting, the application

comes with 12 predefined income heads that are essential

for student fee management and other institutional receipts.

These default heads are system-protected, which means

that users are not allowed to edit or delete them. This restriction

safeguards the integrity of records and prevents errors in standard reporting.

Default Income Heads

- MONTHELY FEE

- BOOKS FEE

- FINES

- CONVEYANCE FEE

- HOSTEL FEE

- EXAM FEE

- OTHER DUES

- ANNUAL / REGISTRATION FEE

- SECURITY REFUNDABLE

- ADMISSION FEE

- PROMOTION FEE

- PRE YEAR ARREARS

User-Defined Income Heads

In addition to the system-generated 12 heads,

users have the flexibility to create unlimited additional heads of income.

This is especially useful when institutions or organizations generate income

from other sources such as donations, grants, rental income, or event charges.

Note: While the default 12 heads cannot be changed,

user-defined heads can be added and managed freely to reflect the

unique income streams of the organization.

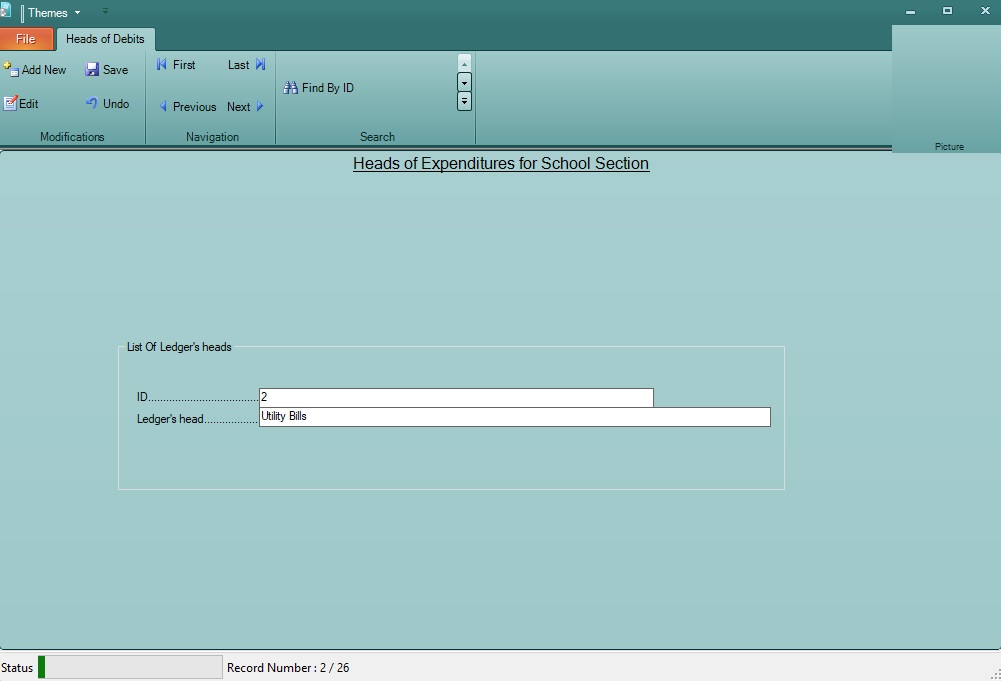

Heads of Debit / Expenses

The Heads of Debit / Expenses sub-module is where users

can define and manage all categories of expenditures. Unlike the

Heads of Credit, there are no system-protected limits here —

users can add unlimited expense heads to suit the needs

of their institution or organization.

This flexibility allows the Systemized Hybrid framework to

adapt to a wide variety of financial structures across different industries

and regions.

Examples of Standard Expense Heads (Globally Used)

Salaries & Wages – Payment to teaching and non-teaching staff.Utilities – Electricity, water, gas, and internet bills.Rent / Lease – Office or building rent expenses.Maintenance & Repairs – Upkeep of buildings, equipment, and transport.Office Supplies – Stationery, printing, and other consumables.Transportation – Vehicle fuel, servicing, and public transport costs.Training & Development – Workshops, seminars, and staff development.Marketing & Advertising – Promotions, campaigns, and outreach programs.Taxes & Government Fees – Statutory obligations and compliance costs.Insurance – Premiums for health, property, and liability coverage.Scholarships / Grants – Financial support to students or beneficiaries.Miscellaneous Expenses – Any other expense not covered in specific heads.

Note: Users are encouraged to create their own expense heads

according to their operational needs. The examples above reflect widely

recognized financial categories used in accounting practices worldwide.

Conclusion

The Income and Expenses module of the

Systemized Hybrid system provides a complete financial framework

to manage both inflows and outflows. With its structured approach of

Bank Database, Credit Heads, and

Debit Heads, users can ensure accuracy, transparency,

and adaptability in their accounting practices.

By combining system-protected standardization with user-defined flexibility,

this module serves as the foundation for generating accurate ledgers,

trial balances, and other critical financial reports.

Frequently Asked Questions (FAQs)

Q1. Can I delete or modify the default 12 income heads?

No. The 12 default heads are system-protected to maintain financial consistency.

However, you can create unlimited new income heads as per your needs.

Q2. What if I don’t have a bank account to manage transactions?

The Bank Database module allows you to record a User Name instead of a

bank name, ensuring smooth account handling without requiring a formal bank.

Q3. Are there any restrictions on creating expense heads?

No. Users can create unlimited debit/expense heads. The examples provided (such as

Salaries, Utilities, Rent, etc.) are globally recognized, but you may add

custom categories relevant to your organization.

Q4. How do these heads connect with reports like Ledger or Trial Balance?

All credits and debits are linked automatically with Ledgers,

Cash Books, and Trial Balance, ensuring accurate

financial statements without manual adjustments.

Q5. Can this system be scaled for large organizations?

Yes. The modular design ensures that both small institutions and large

organizations can use the same structure while customizing expense and

income heads as required.